GST Return Filing Arbitration Business – In the GST Regime compliance is mandatory and every business has to file their monthly and annual gst returns to the government in India . Checking to each and every column of GST returns and also filing it according to the rules and regulations of GST authorities is not easy . For this business owners have to appoint accountants and associate with Chartered accountants for taking care of their GST Compliances. In between , a new business emerged where people are now receiving a commission over offering GST Compliance and return filing services online while they are taking help of professionals to do rather than being themselves the GST qualified.

Getting gst work done for a business from a CA or any GST professional and receiving commission for the service in between is considered as the GST return filing arbitration business. If you want to know more about this GST new business technique , then read this article carefully.

[lwptoc]

Online GST Filing Arbitration Business

GST return filing arbitration works in a simple manner where you get to your local business entities near in your area and you approach them with a service of helping them filing their GST returns for some amount . Now on receiving their service , you can get their tax returns filed through a CA and get a commission from the CA for bringing them the client .

You can pick the data from the shopowner of bills , invoices and payment statements .Provide it to CA to handle and get the return filing of GST done through him. This is the entire concept of GST return filing arbitration online.

Earning from GST Return Filing Arbitration

Their is a simple math involved in this business where you can earn money for each client you add on for instance , in your area the CA is charging Rs 250 per GST return for filing per month. Now you can charge your customer Rs 400 per return for taking their documents and filing their returns.

For 10 clients every month , you can earn a commission of Rs 1500 for not doing anything and just referring the client to your nearest Chartered Accountant .

What is the risk of GST Return Filing Arbitration Business ?

For GST Return filing and other compliance filing the person should hold the basic knowledge of taxation and GST also . As it can create problems if data of a firm or company is mixed with other for GST Filing . Also , there are different compliance involved in gst return filing and information all has to be kept secret and confidential from others which can also posses a risk on the person who is doing the arbitration service of gst return filing.

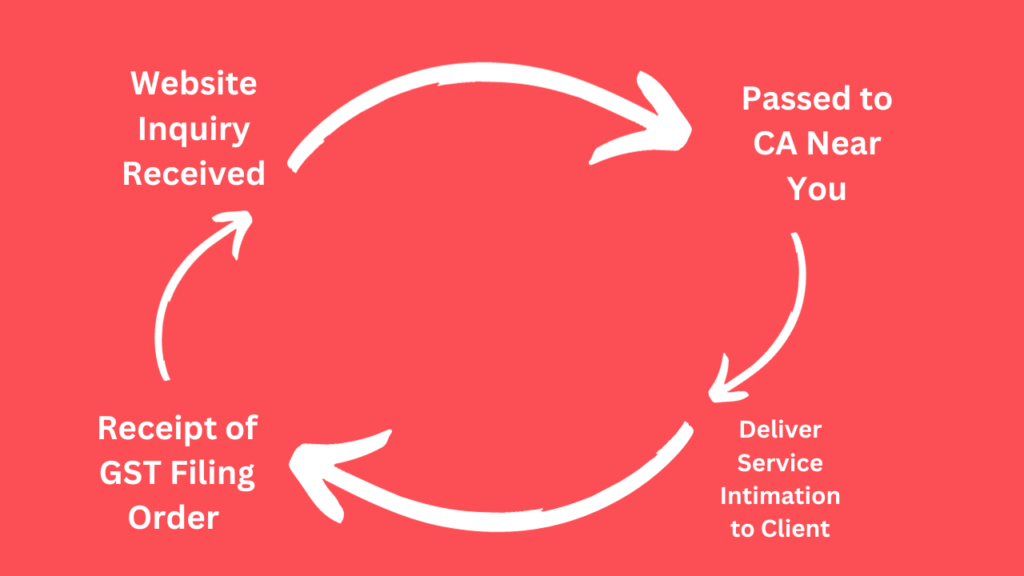

Process of GST Return Filing Arbitration Business

It is easy to start a GST Return filing arbitration business online :

- Create a website with the most demanded CA Services in your area.

- List all the services like GST Return filing , GST Registration and GST Cancellation in your area.

- Once you receive a query take all the necessary documents from the client for service delivery .

- Provide the documents to CA or any financial expert or freelancer CA for providing the service.

- Get paid from the client .

Running GST Return Filing Business through a Website

It is easier to start a GST Return filing arbitration business through online means where you can list all the services and keep a records of all the Chartered Accountants in your area and get those returns filed in your area. You can keep the commission and provide the service work to them at no additional cost making you decent profits.

Promotion of GST Return Filing Arbitration Online

It is easier to promote your GST Return filing arbitration business online where you can :

- Place ads on Instagram

- Create local ads in your area through Google Ads.

- Reach out to ventures and entities physically .

How online e-tax compliance portals work in GST Return Filing Arbitration Business ?

Some of the online e-tax or compliance portals like CAONWeb or TAXSaathi provide GST filing services and other CA Compliance services online . While in some cases , in their network they appoint a professional to provide services to the clients in their area. . On receipt of GST filing services order , you can pass on to the nearest CA service provider on a lower quotation and can earn money in between as commission .

Demand of GST Return Filing Arbitration and CA Services

There is a great demand of GST Return filing and CA Services in India , as a major compliance in business today is related to GST filing and GST Registration . So , you can easily work on these grounds to provide GST return filing arbitration services to your customer .

Monthly Compliance of GST Return Filing and Making Money with Arbitration of Compliance

In GST , the monthly compliance of every business owner is :

- Monthly gst filing

- Reconciling bank statements

- Checking invoices

- Checking bills

- Checking TDS and other deductions

- Checking returns and refunds

- Checking pending tax credits

- Checking input credits etc.

Can GST Return Filing Arbitration Business be done from Home

Yes , it is a healthy business practise to provide a client the most satisfied service. You can start CA Compliance services business online through a website , a whatsapp channel or even through your Facebook account or Instagram account . You can keep the database of GST Filers and CA in your area and can forwards them the service contract any time you want .

Also read : How to become a Journalist with a News Channel on Facebook and Make Money ?

Investment in GST Return Filing Arbitration

There is no investment required to start a GST Return filing arbitration business . For online promotion , you can start with a website where you can receive inquiries of your clients for GST return filing and you can pass onto their needs to the nearest CA or professional GST expert for filings.